Highlights:

- The legal cannabis market is here to stay, and is expected to continue to grow past 2030. There are known challenges, however, including the continued existence of the illegal market (albeit at reduced levels).

- The market is maturing since the “gold rush” of 2017–2020, with some consolidation happening in agricultural production and product manufacturing. Mom and pop growers and retailers are having an increasingly difficult time.

- Profitability of cannabis-related businesses is rising overall thanks to inputs from prior investment funding, research and development, and process improvement efforts.

See below for all sources.

The legal cannabis industry still inspires those who are keen to seek their fortune. Even before Canada became the second nation to legalize cannabis in 2018, the stampede of investment and entrepreneurship in the industry was clear.

Part of the excitement stemmed from the potential for new small-scale growers and retailers to make their mark, as well as large players. There is an artisanal aspect to some cannabis businesses that can mean opportunity to small, community-oriented entrepreneurs who don’t aspire to be the next Canopy Growth.

But the legal cannabis industry is undergoing some growing pains as it matures, as all industries do. Factors ranging from shifting economic landscapes (oil price volatility, supply chain issues) and the advantages of economies of scale will continue to make a significant impact on the future of the industry. As the industry as a whole matures, some observers are predicting consolidation as larger organizations outlast or buy out smaller ones.

It’s also important to remember that there are three main markets that the industry serves: medical use, recreational use, and other additional hemp products (used in everything from clothing to industrial uses to carbon capture). The outlook is changing for each of these segments in unique ways.

What follows is a high-level look at some of the forces that are shaping the future of the cannabis market, and some of the recent trends.

Analysts Continue to Predict Overall Growth

IBIS World reported that the cannabis market contributed over $17 billion to the Canadian economy as of 2021. The United States’ much larger market benefitted by $25 billion in 2021, a 40% increase over the previous year, according to data from BofA Securities.

While markets have returned to a more reasonable level since the first heady days of legalization, a variety of analysts have predicted continued and significant growth in the North American market.

The US cannabis industry will generate $85 billion in sales by 2030, according to Cowen analyst Vivien Azer. IBIS World reports that Canadian industry revenue is expected to grow an annualized 7.6% to $8.5 billion over the five years to 2026. Frontier Data is projecting growth as high as $9 billion over the next decade.

Profitability

Profitability for the cannabis industry in Canada, however, is still currently negative at -17.6% due to heavy initial investment, taxation, competition from the illegal market, and ongoing struggles to put prices within reach of consumers, according to IBIS World. As growers optimize efficiencies, profitability is expected to improve.

The outlook from the US is similar: a survey of 396 cannabis operators by the National Cannabis Industry Association reported that 37% weren’t profitable yet. The ones that were profitable had sizable funds ($2.5M+) to draw upon when prices drop.

Medical Cannabis Market: Mixed Signals

The market for products containing CBD (cannabidiol) — a compound found in cannabis that doesn’t make you high but helps some manage chronic pain and other conditions — is projected to grow in the United States. This is thanks in part to the FDA’s statement in 2018 that it will be re-evaluating its stance on including pharmaceutical ingredients in food or dietary supplements.

In Canada, the use of medical marijuana has stalled, while the recreational market has grown.

Factors That Affect Demand

The Progress of Legalization

One of the largest factors affecting the health of the cannabis industry is the continued trend towards legalization, especially in North America.

The first country to legalize recreational use of cannabis was Uruguay in 2013. In Canada, medical marijuana use has been legal (if strictly controlled) since 2001, while the recreational market didn’t come under the starter’s pistol until October 17, 2018.

The first jurisdiction in the United States to decriminalize, or reduce penalties, for marijuana possession was Texas in 1973, with Oregon, Alaska, Minnesota, and others quickly following suit. Colorado was the first state to make the sale and use of cannabis for recreational purposes fully legal in 2012. Today, cannabis and/or hemp is already legal in 35 states, with 16 states allowing adults to use it for recreational purposes. Proposals to expand access are on the agendas of many other states.

Around the world, South Africa, Malta, Georgia, Mexico and Uruguay have legalized recreational use, and dozens more have legalized medical use. (In the Netherlands, purchase of small amounts by citizens is tolerated under strict conditions, but not fully legal.)

Changing Consumer Views

In North America, consumer attitudes towards cannabis (both medical and recreational) are changing as legalization progresses and usage becomes normalized. The fact that cannabis growing and product manufacturing contributes jobs and other economic benefits may be a contributing factor.

A 2021 Gallup poll found that 80% of Americans support the legalization of medical marijuana, and 60% support the use of recreational and medical use — contrast this against just 12% in 1969 (according to Pew Research Center). The stigma associated with recreational cannabis use started to erode when the baby boom generation became old enough to use it and has continued ever since.

Aging Populations

Because populations are aging overall, demand for medical cannabis products is increasing.

The baby boom generation is currently entering its retirement years, and is starting to experience age-related conditions that can be treated with medical cannabis, like glaucoma, arthritis, and Alzheimer’s. Use of cannabis as a treatment for these conditions, as well as ongoing chronic pain, is becoming more accepted by doctors and patients alike.

Levels of Disposable Income

Demand is also affected by disposable income, which grew in Canada from 2017–2022 at an annualized growth rate of 1.9%. In the United States the picture is even better, with 2.2% growth in the same period.

During the COVID-19 pandemic, per capita disposable income continued to increase in Canada thanks to stimulus funds released by the federal government. In 2022, in spite of the effects of inflation, disposable income is expected to hold steady (IBIS World predicts a 0.04% increase).

In the United States, however, IBIS World expects a 2.1% decline in 2022 as the Federal Reserve raises interest rates.

Managing Safety Concerns

In the lead up to legalization in Canada, two potential issues were widely talked about: the potential for impaired driving and keeping cannabis out of the hands of minors.

First, the good news: there doesn’t seem to have been a rise in impaired driving post-legalization. Research by UBC’s Professor Russell Callaghan indicates that traffic injuries have not risen significantly, and a report by Mothers Against Drunk Driving (MADD) agrees that charges of impaired driving against drug users is “extremely low” at 11% of all impaired driving charges. Police are able to do roadside testing for the presence of cannabis in the blood, although tests that can determine the exact level of cannabinoids in the blood are still not available.

The picture of negative health impacts on children and youth is still unclear, but does pose some initial cause for concern, however. There has been an upward trend in emergency room visits by youth because of overuse of cannabis according to Callaghan’s research. Some health care workers are also concerned about new, stronger varieties of cannabis that contain more psychoactive compounds. Efforts to educate parents about keeping products, especially edibles and drinks, locked up and out of reach are ongoing.

Challenges Facing the Cannabis Industry

There are several sets of challenges to profitability of the cannabis industry. A primary factor is competition from the illegal market (although that has dropped in Canada by about 50% since legalization).

There are a couple of impacts made by the fact that the industry is very new. It has suffered from the giddiness of the post-legalization “gold rush fever”: while demand has grown, for many years the industry now has been oversupplied. This, coupled with price-shopping by consumers, has brought prices down.

Growers and manufacturers are both still figuring out how to run these businesses, and how to overcome challenges like managing security, optimizing growth of crops (including managing disease) and developing processes for products like beverages, edibles, and topicals. Once efficiencies mature, profit margins should become more healthy.

Security is a rising concern for growers and retailers, with cash being the primary draw for robberies of retailers. Taking advantage of security technology and store design practices are no longer optional.

Agriculture

Growers face a number of specific challenges:

- Operating costs are high, including labor costs. This is because the plants are very delicate when young, and have to be carefully transplanted as seedlings.

- Cannabis plants also require a lot of light, and are often grown under partly or fully artificial light.

- Fertilizers and pesticides are predominantly products of the oil and gas industry, which is notorious for price volatility.

- Testing costs, including operational tests for monitoring crops and improving efficiency, can also be significant.

Like many other businesses, growers are expected to start leveraging new technology like machine learning, IoT, and robotics.

While agribusiness is no stranger to the efficiencies brought by economies of scale, there are factors that may potentially limit the advent of “big weed”, however. For one thing, the market has a soft spot for locally grown, craft-scale product. Further, the variety of different strains available may make specialization more of a challenge, according to Ryan Stoa, Concordia University law professor and author of Craft Weed: Family Farming and the Future of the Marijuana Industry.

Product Manufacturing

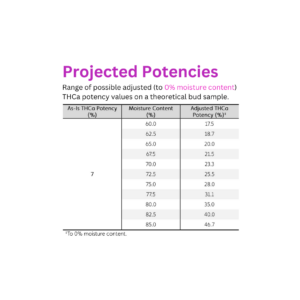

Cannabis products include everything from edibles like candies and drinks to topicals. For manufacturers, challenges include processing difficulties, including keeping levels of cannabinoids standardized and within acceptable limits. The difficulties escalate as companies learn how to do this at scale.

Retail

Opening a cannabis retail store isn’t a guaranteed windfall anymore, largely because of competition. Canada alone has over 2,500 legal stores across the country. Some large cities, like Toronto, have a very high concentration of stores, especially since the COVID-19 pandemic began.

Retailers who took advantage of closures of other types of stores to secure commercial real estate were faced with having to figure out curbside pickup and sometimes even delivery.

Operational Efficiency Is the New Key to Success

While the overall outlook for the industry is positive, it’s no longer a smart option to enter the cannabis industry without a plan. Business owners have to do their homework, look for efficiencies, and continue to refine processes.

If testing has become a bottleneck for your organization, Ekidna can provide rapid, decentralized, and accurate testing.

Sources

- IBIS World: Per Capita Disposable Income (Canada), April 2022 (https://www.ibisworld.com/ca/bed/per-capita-disposable-income/15/)

- Forbes: The American Entrepreneur is Alive and Well — in Cannabis, Andrew DeAngelo, April 2022 (https://www.forbes.com/sites/andrewdeangelo/2021/04/30/the-american-entrepreneur-is-alive-and-well-in-cannabis/?sh=204d3c904e91)

- US News: Where is Marijuana Legal? A Guide to Marijuana Legalization, Claire Hanson, Horus Alas, and Elliott Davis Jr., April 2022 (https://www.usnews.com/news/best-states/articles/where-is-marijuana-legal-a-guide-to-marijuana-legalization)

- Marijuana Venture: The New Bank Robberies, Brian Beckley, April 2022 (https://www.marijuanaventure.com/the-new-bank-robberies/)

- IBIS World: Per Capita Disposable Income (United States), March 2022 (https://www.ibisworld.com/us/bed/per-capita-disposable-income/33/)

- North Bay Business Journal: Survey: 37% of US Cannabis Operators Say They’re Not Profitable, Susan Wood, March 2022 (https://www.northbaybusinessjournal.com/article/industrynews/survey-37-of-us-cannabis-operators-say-theyre-not-profitable/)

- IBIS World: Industrial Hemp Production, Jack Curran, February 2022

- Seeking Alpha: US Legal Cannabis Sales Grew 40% in 2021 – BofA, Jonathan Block, January 2022 (https://seekingalpha.com/news/3785876-us-legal-cannabis-sales-grew-40-in-2021-bofa)

- Investopedia: The Future of the Marijuana Industry in America, Deborah D’Souza, December 2021 (https://www.investopedia.com/articles/investing/111015/future-marijuana-industry-america.asp)

- BNN Bloomberg: Three Years Post-Legalization, Canada’s Cannabis Industry Ready for a Reset, David George-Cosh, October 15, 2021 (https://www.bnnbloomberg.ca/three-years-post-legalization-canada-s-cannabis-industry-ready-for-a-reset-1.1667013)

- CBC News: The Pros, Cons, and Unknowns of Legal Cannabis in Canada 3 Years Later, Richard Raycraft, October 2021 (https://www.cbc.ca/news/politics/cannabis-changed-canada-1.6219493#:~:text=On%20Oct.,had%20a%20number%20of%20goals.)

- IBIS World: Cannabis Production in Canada, Shawn McGrath, April 2021

- IBIS World: Medical and Recreational Marijuana Growing, Brigette Thomas, March 2021

- ScienceDaily: Cannabis Strength Soars Over Past Half Century, University of Bath, November 2020 (https://www.sciencedaily.com/releases/2020/11/201116092241.htm)

- IBIS World: Cannabis Production in Canada, Santiago Irigoyen, October 2019

- Cannabis Market: Products, Technologies, and Applications, Marianna Tcherpakov, PhD, December 2019

- Belleville Intelligencer: New OPP Roadside Units Can Detect Cannabis Use in Drivers, Derek Baldwin, December 2019 (https://www.intelligencer.ca/news/local-news/new-opp-roadside-units-can-detect-cannabis-use-in-drivers#:~:text=The%20days%20when%20being%20high,at%20roadsides%20in%20the%20province.)

- BBC News: Canada Becomes Second Country to Legalise Recreational Cannabis, October 17m, 2018 (https://www.bbc.com/news/world-us-canada-45806255#:~:text=Canada%20follows%20in%20the%20footsteps,for%20recreational%20use%20in%202013.)

- Wikipedia: Timeline of Cannabis Laws in the United States (https://en.wikipedia.org/wiki/Timeline_of_cannabis_laws_in_the_United_States)

- Wikipedia: Legality of Cannabis, (https://en.wikipedia.org/wiki/Legality_of_cannabis#:~:text=Countries%20that%20have%20legalized%20recreational,Australian%20Capital%20Territory%20in%20Australia.)